In 1776, Adam Smith published The Wealth of Nations, a groundbreaking work that laid the foundation for classical economics. In this influential text, Smith described how wealth was created primarily through land ownership, agriculture, and trade. At the time, landowners (landlords) and farmers were at the top of the economic hierarchy, while consumers and laborers occupied the bottom. Fast forward to 2024, and the economic landscape has shifted dramatically.

This blog post explores how the role of land has evolved since Adam Smith’s time, and how today’s economy reflects a new hierarchy. While land still holds value, new economic forces such as technology, finance, and urbanization have redefined its place in our society.

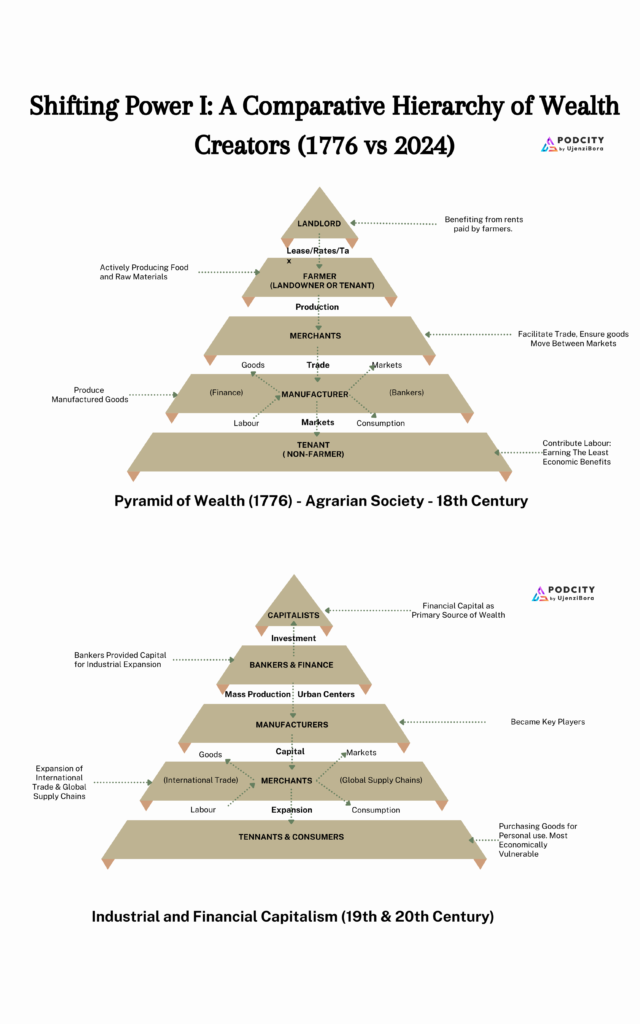

The Original Hierarchy of The Wealth of Nations (1776)

In the 18th century, land was the cornerstone of wealth. Wealthy landowners leased land to farmers, who cultivated it to produce crops. Agriculture was the most productive use of capital, and those who controlled land reaped the greatest economic rewards.

- Landlords were at the top, benefiting from rents paid by farmers for the use of their land.

- Farmers were next, as they actively engaged in producing food and raw materials.

- Merchants facilitated trade, ensuring that goods moved between markets.

- Manufacturers produced goods, though at this stage, manufacturing was still less significant than agriculture.

- Consumers and Laborers formed the base of the pyramid, contributing labor but earning the least economic rewards.

This pyramid reflected an agrarian society where land ownership determined wealth and power. Agriculture was the engine of the economy, and those who owned or controlled land were positioned at the top.

The Shift to Industrial and Financial Capitalism

With the onset of the Industrial Revolution, the hierarchy began to shift. Factories and industrial production became dominant forces in the economy, and the importance of land ownership diminished in favor of industrial capital.

- Manufacturers became key players, as industrialization allowed for mass production and the growth of urban centers.

- Bankers and Financial Institutions grew in power as they provided the capital necessary for industrial expansion. These institutions facilitated investments in both land and factories, helping fuel economic growth.

- Merchants continued to thrive as international trade expanded, linking countries through global supply chains.

By the late 19th and 20th centuries, financial capital had overtaken land as the primary source of wealth, creating a more diversified economic landscape. Land was no longer the sole determinant of wealth, but it remained a valuable asset, especially in urbanizing regions.

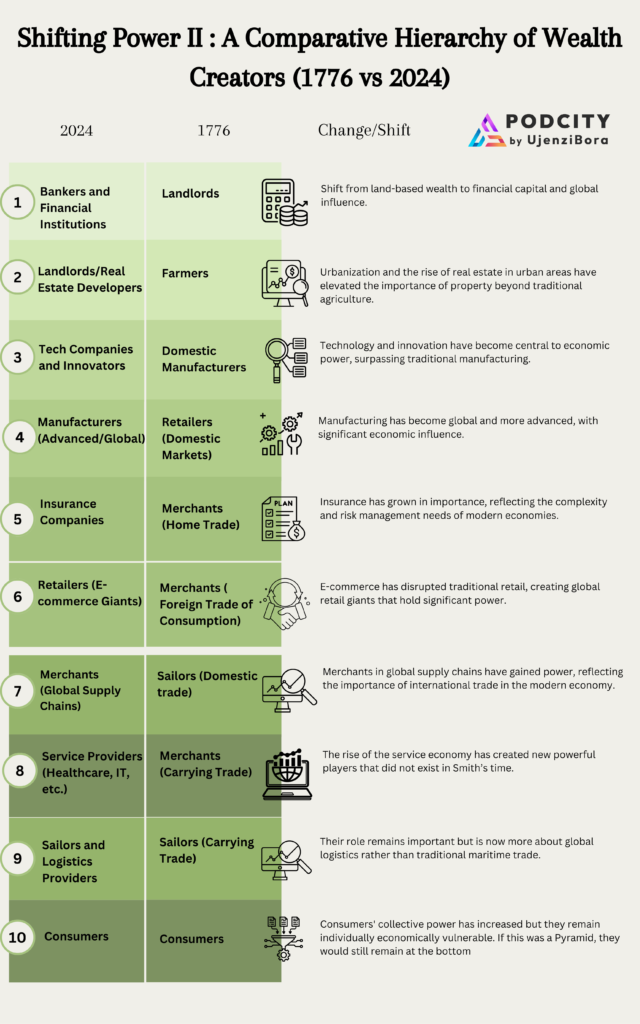

The New Hierarchy of 2024: The Hourglass Economy

In 2024, the economic hierarchy looks more like an hourglass than a pyramid. At the top, a small elite holds significant wealth and power, while the middle class has shrunk, leaving a broad base of economically vulnerable individuals at the bottom.

The Top of the Hourglass: Concentrated Wealth

Today, the top tier of the economic hierarchy is dominated by three key players:

- Bankers and Financial Institutions: The control of global capital, credit, and investments has placed financial institutions at the pinnacle of economic power. They enable growth across all sectors and often dictate the flow of money worldwide.

- Tech Companies and Innovators: Technology giants such as Google, Apple, Amazon, and Microsoft have created unprecedented wealth by controlling platforms, data, and innovation. Their influence spans across industries, reshaping global markets and consumer behavior.

- Real Estate Developers and Urban Landowners: While rural land is less central, urban land has become incredibly valuable. In cities, where space is limited and demand is high, real estate developers have become some of the most powerful economic players, especially in major urban centers like New York, London, and Shanghai.

The Narrow Middle: Shrinking Middle Class

The middle of the hourglass reflects the decline of traditional manufacturing and the rise of automation. Small and mid-sized manufacturers, once the backbone of the economy, have faced intense pressure due to offshoring, technology, and consolidation.

The Broad Base: Consumers and Laborers

At the bottom, consumers and low-wage laborers, including gig workers, form the largest part of the economy. While these individuals are essential for economic activity, they often face wage stagnation, job insecurity, and limited upward mobility.

The Place of Land in Modern Society

Urban vs. Rural Land

In Adam Smith’s time, rural land was the primary source of wealth, as agriculture was the main economic driver. Today, urban land is far more valuable, as cities are the centers of commerce, innovation, and culture. Urban landowners and developers who can create high-demand properties, particularly in global cities, hold significant wealth.

Real Estate as the New “Land”

While traditional agricultural land has become less central to wealth creation, real estate development in cities has taken its place. Owning prime real estate in key urban areas can yield massive returns, as urban populations grow and land becomes scarce.

Agriculture’s Role Today

Agriculture is still important, especially with rising concerns over food security and sustainability. However, modern agriculture relies heavily on technology, allowing for more efficient use of land. Furthermore, new trends such as organic farming and renewable energy (e.g., solar farms) have introduced different ways of using land to generate value.

New Power Structures in 2024 and Beyond

In today’s economy, power is concentrated among those who control capital, technology, and urban real estate.

- Bankers and Investors: The ability to direct capital flows has given bankers unprecedented influence over the global economy. Whether through venture capital, private equity, or large institutional investments, financial capital controls everything from real estate development to tech startups.

- Tech Companies: Innovation and data control have made tech giants economic powerhouses. Their ability to shape consumer behavior, control digital infrastructure, and push the boundaries of artificial intelligence has redefined economic power.

- Globalization: As capital flows across borders, economic power has become more decentralized. However, globalization has also created inequalities, as those who can navigate global markets are positioned to benefit the most, while others are left behind.

Adam Smith’s The Wealth of Nations may have been written in 1776, but its core ideas still resonate today. The place of land in society has shifted, yet its importance remains. The world has moved from an agricultural economy to one driven by finance, technology, and services, but land—whether rural or urban—continues to play a crucial role in wealth creation.

The challenge of 2024 is to understand how land fits into the broader economic picture, especially as we face new challenges like urbanization, sustainability, and the digital economy. From The Wealth of Nations to the new hierarchy of today, the landscape of wealth may have changed, but the importance of land has endured in new and evolving ways.