As a career civil servant, you’ve dedicated many years to serving the public. Now, as you look toward retirement and contemplate the future of your investments, particularly your various land parcels, it’s important to strategize carefully. This guide aims to provide you with valuable insights into managing your real estate assets and planning for a secure, rewarding retirement.

1. Consolidation and Efficient Management:

Assess your land parcels considering their current market values, their potential appreciation, and the costs associated with managing them. If any parcels aren’t likely to appreciate significantly or pose high management costs, selling them to consolidate your assets might be an effective strategy.

2. Exploring Real Estate Development:

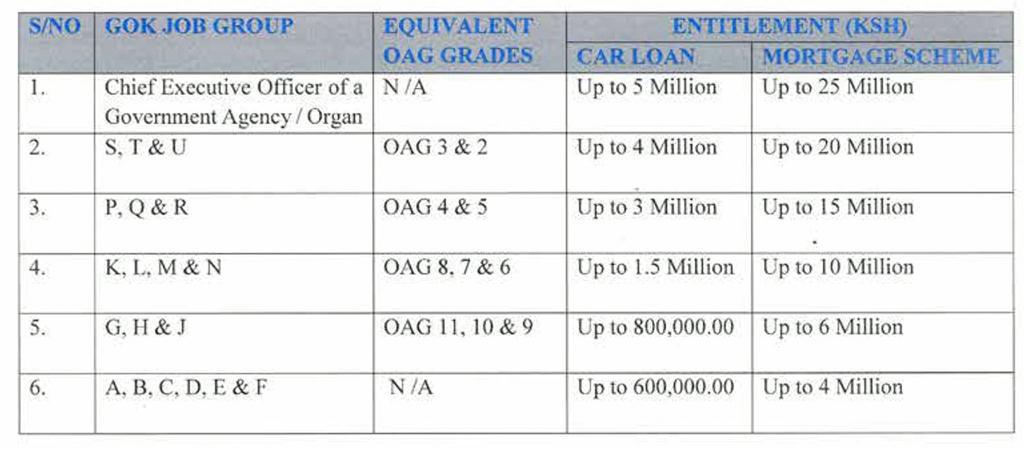

Your knowledge as a civil servant could be a valuable asset in developing some of your parcels. This could be residential or commercial structures, or a mix of both. The development would depend on the location and characteristics of each parcel, alongside market trends in each area.

3. Harnessing the Power of REITs:

Real Estate Investment Trusts (REITs) are companies that own, operate, or finance income-generating real estate. They allow individual investors to earn dividends from real estate investments without the need to manage properties. This hands-off approach could be a valuable asset for your retirement.

4. The Potential of Land Leasing:

Depending on the location and zoning regulations of your parcels, leasing them to businesses for uses such as agriculture, renewable energy production, or telecommunications could be a profitable venture.

"Cultivating a secure retirement isn't simply a matter of savings and investments. It's about intelligently leveraging all resources at your disposal. When managed strategically, real estate can serve as a robust pillar of a well-rounded retirement plan.

QS. Nahinga David Tweet

5. Sustainable Ventures in Eco-Tourism:

In line with global sustainability goals, you could turn some of your parcels into eco-tourism ventures. This not only generates income but also contributes to the well-being of the environment and local communities.

6. Diversifying Your Investment Portfolio:

A balanced portfolio spread across various investment types including stocks, bonds, mutual funds, or even digital assets can enhance returns and mitigate risks.

Now, let’s delve into retirement planning. Consider the following key aspects:

- Income Planning: Define your desired retirement lifestyle and calculate the regular income needed to sustain it.

- Asset Liquidation: Formulate a plan on when and how you’ll liquidate your investments to generate the needed income.

- Estate Planning: Consult with legal experts to ensure your assets are passed on to your heirs as per your wishes.

- Healthcare and Long-Term Care: Don’t forget to factor in costs associated with healthcare and long-term care in your retirement plan.

7. Conclusion:

Remember, this is a broad overview, and the specifics will depend on your individual goals, the nature of your land parcels, and market conditions. As you embark on this journey, consider enlisting the help of financial advisors, tax consultants, and real estate professionals to aid in your retirement and investment strategies. Enjoy your journey into retirement with the knowledge that you’ve made informed decisions about your future.

7. Books and online resources to Deepen Understanding:

“The Book on Rental Property Investing” by Brandon Turner: This book provides valuable insights into managing and profiting from rental properties.

“The Intelligent REIT Investor: How to Build Wealth with Real Estate Investment Trusts” by Stephanie Krewson-Kelly and R. Brad Thomas: It’s a comprehensive guide to investing in Real Estate Investment Trusts.

“How to Retire Happy, Wild, and Free: Retirement Wisdom That You Won’t Get from Your Financial Advisor” by Ernie J. Zelinski: Offers an interesting perspective on planning for the non-financial aspects of retirement.

“The Bogleheads’ Guide to Investing” by Taylor Larimore, Mel Lindauer, and Michael LeBoeuf: A practical guide to constructing a diversified portfolio.

“Principles: Life and Work” by Ray Dalio: Dalio shares unconventional principles that he’s developed, refined, and used over the past forty years to create unique results in both life and business.

“The Black Swan: The Impact of the Highly Improbable” by Nassim Nicholas Taleb: It’s a book about handling unexpected events, an interesting read for someone like you who values non-consensus insights.

“The Beginning of Infinity: Explanations That Transform the World” by David Deutsch: If you’re interested in epistemology, Deutsch’s works might be right up your alley.