Saving Money for Your Bungalow: Budgeting Strategies for Homeowners

Saving Money for Your Bungalow: Budgeting Strategies for Homeowners

Introduction:

If you are planning to buy or build a bungalow as your residence, it is essential that you manage your finances wisely. You cannot afford to splurge on this house and then struggle to make ends meet for the rest of your life.

Your home will be one of the biggest expenses of your life, so it’s important that you plan accordingly.

To help you avoid any nasty surprises, we have put together some budgeting tips for buying or building a bungalow. From understanding the financial commitment of buying or building a home to identifying how much money you can actually save each month by moving out of your current apartment or renting a smaller place. Take a look:

How much money do you need to buy or build a bungalow?

The cost of a bungalow will depend on various factors such as location, size, contracting method used to build it, types of finishes, and owner’s budget. According to our estimates, you can expect to spend between Kes. 3,000,000 and Kes. 15,000,000 on a bungalow in the Kenya.

If buying, the purchase price of the property will be just one part of your overall investment. You will also need to factor in other expenses such as closing costs, down payment, mortgage rates, property taxes, and homeowners insurance. Hence, it’s important that you know exactly how much money you will need to buy a house. Once you have a clear idea of your budget, you can start thinking about ways to save money.

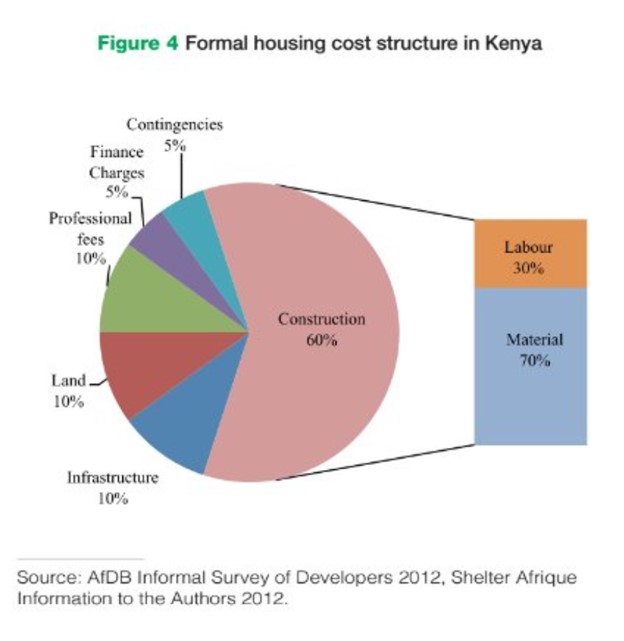

If Building, this graph shows the formal housing cost structure in Kenya:

This means, if you can master the land buying process and avoid the need to “fit in”, you will halve your overall cost of home ownership. (10% to 20% of Capital Invested is on Land)

If you buy a ready built house, the cost of land alone can be inflated by up to 50%. This scenario does not apply where the house is part of an apartment, duplex or other fractional ownership schemes.

In fractional ownership schemes, the cost of land is shared amongst the units available for sale. This means multiple dwellings have a reductionist effect on cost of land.

What is included in the bungalow budget?

Cost Spread When Buying?

The first thing you need to do when preparing a budget for buying a bungalow is to identify all your fixed and variable costs. This will help you understand the total commitment that you will be making each month.

These are the fixed costs you will be obligated to pay each month regardless of whether you are living in an apartment or a bungalow: –

Mortgage principal: The mortgage principal is the money you borrowed from the bank to buy the house. The rest of the money is the amount you have put down as a down payment.

Monthly Payments: You will need to make monthly payments to the bank to repay your debt. This will be your main fixed cost and will usually be between 25,000 and 90,000 all dependent on the terms and conditions of your Mortgage Loan.

Taxes: Taxes are another fixed cost that you will need to pay while undertaking the transaction. As a new landowner with a bungalow, you will need to pay annual Land Rates and obtain a Land Rates Clearing Certificate. Factors such as the location and property value will determine the amount you need to pay. You can look up the property tax rate in your area to have an idea of how much you will need to pay annually.

Insurance: Insurance is a fixed cost that you must pay. It is prudent to buy homeowners insurance to protect you in case of any damage to the property. The amount you pay for insurance will depend on the type of coverage you want, the size of your bungalow, and its location.

Repairs and maintenance: It is inevitable that something will break in your home. This is why you need to factor in periodic repairs and maintenance costs when budgeting for a big purchase. The good news is that you can deduct these costs from your taxes.

Utilities: The larger the house, the more energy it will consume. Hence, the cost will be higher than in a smaller bungalow. Therefore, it is important to consider these variable costs when calculating your budget.

Cost Spread When Building?

The Cost Spread for a typical Bungalow comprising a Lounge, Kitchen and two to four bedrooms based on an analytical analysis of Elements reveals the cost is as follows:

- Substructures 21.3%

- Beams/Columns 5.66%

- Walling 9.11%

- Roof 12.42%

- Windows 6.43%

- Doors 8.67%

- Finishes 22.89%

- Joinery 8.48%

- Sanitary Fittings 5.05%

Total Cost is 100%. Notice i have not included your typical items that are considered extras in a house like Landscaping, Solar Water Heating, Connection to Water and Power Mains et Cetera. These are plug and play items done by specialists or state actors at reasonable fees.

Talk to a Quantity Surveyor to help you understand better the Costs of your Proposed Bungalow Project. A Building Contractor can also advice on this.

Decide on your priority and plan accordingly

According to the Centre for Affordable Housing Finance, “Households continue to be the primary supplier of their own affordable housing – incrementally realizing their goal for adequate housing.”

When you decide to buy a bungalow, it is important to understand that this is a long-term investment. Moreover, you will be spending a considerable amount of money on the house. This means that it is essential to prioritize your expenses.

In order to make sure you are financially prepared for homeownership; you need to make some sacrifices. It is important that you cut down on your monthly expenses as much as possible. Start by reducing your monthly bills and start saving as much money as you can.

You can also start spending 5 years ahead of time by actually buying he land at your preferred location, getting power and water connection and planting a garden. There is no rule of thumb on where exactly one can start their home ownership journey. Every step counts, if you fully understand the bigger picture.

Conclusion.

Building or buying a bungalow is a big investment decision. It is important that you manage your finances wisely and plan for it as much as possible. It is also essential that you are financially prepared for homeownership.

At Ujenzibora, we believe everyone deserves to live a good life. We are here to share Knowledge, Design, Cost and Build Houses to make this vision possible.